Beyond Billing: Customer Adoption & Self-Service Hub (CASH)

Why it matters

Customers expect real‑time visibility and control. CASH shifts routine interactions to digital self‑service, accelerates payments, increases trust, and reduces churn. This is how enterprises modernize the Quote‑to‑Cash experience.

- Reduce support costs by up to 50%

- Accelerate collection cycles by ~25%

- Cut invoice disputes by up to 40%

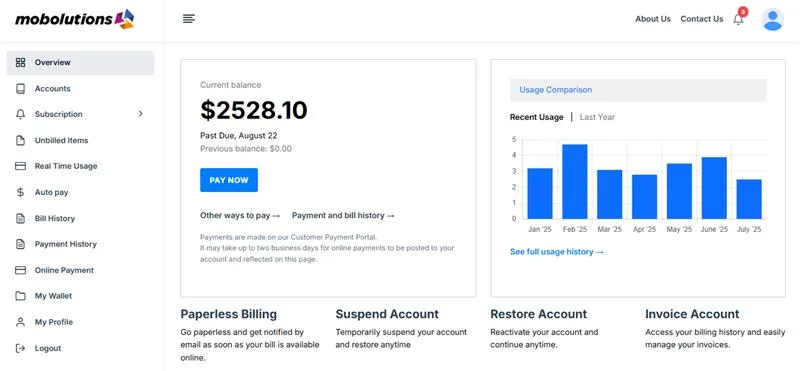

Solution Features

Invoice clarity &

control

View, download, and dispute invoices online.

Frictionless payments

Manage wallets to keep accounts current.

Full account

transparency

Real‑time balances, billed & unbilled usage, subscriptions.

Secure

access

Role‑based, MFA‑enabled login for strong protection.

Subscription

flexibility

Pause, resume, upgrade, or cancel anytime.

Stay

informed

Alerts for billing cycles, renewals, and usage thresholds.

Actionable

insights

Analytics across billed & unbilled items.

Personalized

dashboards

Analytics across billed & unbilled items.

Value delivered → Benefits recognized

50%

25%

40%

10–15%

30%

Enterprise‑grade

Platform

advantages

- SAP‑native Q2C architecture. Embedded, not bolt‑on.

- Works with S/4HANA Billing, Revenue Accounting, and related Q2C modules.

- Designed by Q2C experts across Telecom, Insurance, Manufacturing, Hi‑Tech.

- Cross‑industry ready for subscription, usage, and recurring models.

- Secure, extensible, high‑performance for large enterprises.

The value in a subscription economy

CASH integrates with SAP Q2C components such as S/4HANA Billing and Revenue Innovation Management to provide real‑time visibility into billed and unbilled items, balances, and entitlements—while enabling customers to order, cancel, or modify subscriptions instantly.

Current capabilities

Roadmap

Coming soon

- Master Agreement & Allowance display

- Entitlement Management (SAP EMS) integration

- AI‑driven recommendations & guided flows

- Personalized dashboards per customer segment

Proof in action

- Trusted by SAP Q2C innovators — results include:

- 50% fewer billing support calls

- 25% faster payment collection

- 40% fewer invoice disputes

- 10–15% higher retention

- 30% fewer manual adjustments

- Example: Sedgwick saw 40% automation improvement, 80% auto‑invoice delivery, and 350% revenue growth using Mobolutions Q2C solutions.